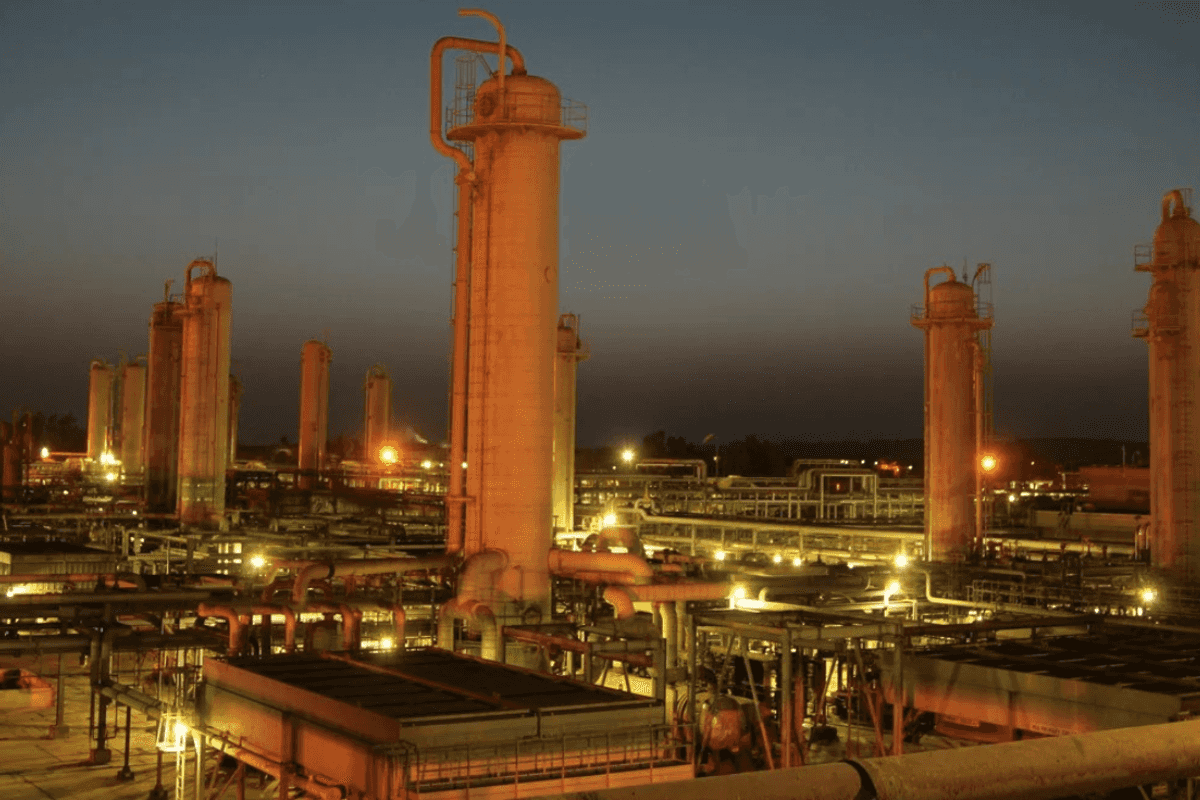

PPL profit falls 26% in FY26's second quarter on lower oil prices, rising costs

Higher expenses and weaker other income offset stable production

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

Pakistan Petroleum Limited (PPL) reported a 26% year-over-year decline in profit for the second quarter of fiscal year 2026, citing lower oil prices, higher operating expenses and reduced other income.

The company posted net earnings of PKR 20.3 billion, or PKR 7.46 per share, compared with PKR 27.3 billion, or PKR 10.05 per share, in the same period last year.

For the first half of fiscal year 2026, profit totaled PKR 40.4 billion, or PKR 14.8 per share, down 21% from a year earlier.

Revenue for the quarter edged up 1% year over year to PKR 61.2 billion as overall oil and gas production remained broadly stable.

Gas output increased at Kandhkot, Sharf and Nashpa fields, while oil production at Nashpa rose slightly. Output from the TAL Block increased 14.3% year over year to 13,908 barrels of oil per day, though production remained below potential due to curtailments.

The decline in profitability was largely attributed to a 13% drop in average oil prices during the quarter, weaker gas production and lower non-core income.

Operating expenses rose 32% year over year to PKR 16.1 billion. Exploration costs fell 74% to PKR 1.33 billion, primarily due to the absence of a dry well expense recorded in the same quarter last year.

Other income dropped 59% to PKR 3.64 billion, mainly due to one-off reversals recorded in the prior-year period. Finance costs declined 24% to PKR 494 million.

The company recorded a loss of PKR 467 million from associates during the quarter, bringing the first-half loss from associates to PKR 566 million.

PPL’s effective tax rate increased to 36.9% in the second quarter, compared with 26.6% a year earlier.

The company announced an interim cash dividend of PKR 2 per share for the quarter, bringing the first-half payout to PKR 4 per share.

Trade receivables rose slightly to PKR 599.9 billion from PKR 595.4 billion in the previous quarter, as the company maintained a recovery ratio of 93%. Cash and short-term investments declined marginally to PKR 90 billion from PKR 92 billion in the preceding quarter.

Company officials said earnings were below expectations due to higher-than-anticipated operating expenses and a sharper-than-expected decline in other income.

Comments

See what people are discussing