Investors’ wealth up 11% in Pakistan’s equity market in Sept

Experts link bullish rally to diplomatic development, macroeconomic stability

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

Domestic mutual fund buying in equities hit a record PKR 25 billion in September

PSX

Pakistan’s stock market surged to a historic high in September, as aggressive local fund inflows, key geopolitical developments, and improving macroeconomic indicators combined to fuel one of the strongest bull runs in recent history.

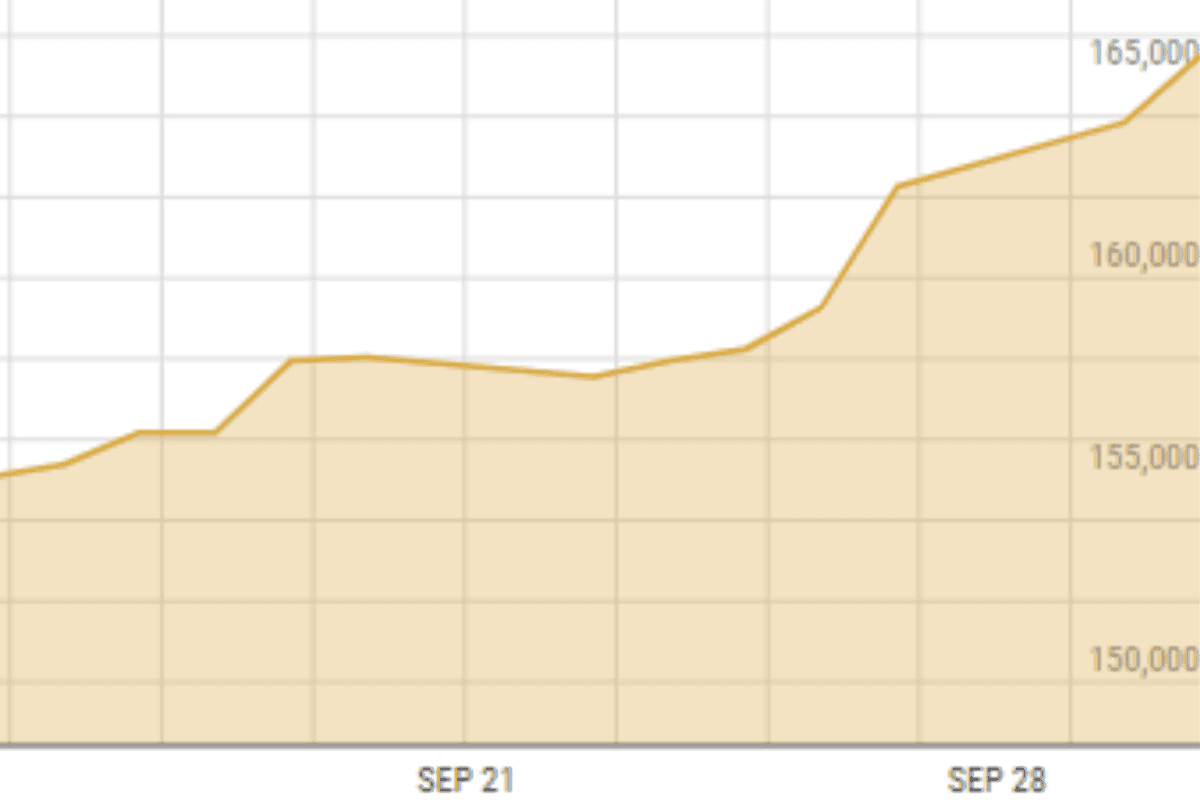

The KSE-100 Index, the country’s benchmark equity gauge, closed September at a record 166,556 points, rising 11% month-over-month and adding 16,876 points in the process. Over the past 12 months, the index has more than doubled, signaling a major turnaround in investor sentiment.

Mutual funds drive rally

At the heart of the rally is a surge in domestic mutual fund buying, which hit a record PKR 25 billion (USD 87 million) in equities in September alone. Over the past three months, mutual funds have accumulated net purchases exceeding PKR 58 billion, amid a favorable investment climate created by falling interest rates and growing investor optimism.

This influx of liquidity pushed daily trading volumes to unprecedented levels. The cash/ready market average volume has increased to PKR 54 billion per day, while the futures market average volume has increased to PKR 17 billion per day

Diplomatic developments boost market confidence

The rally was amplified by a string of high-impact diplomatic engagements and strategic agreements. Recently, Pakistan and Saudi Arabia signed a Strategic Mutual Defense Agreement (SMDA) to deepen military and economic ties.

In a separate development, Prime Minister Sharif met with US President Donald Trump at the White House, where the American leadership reportedly expressed strong interest in exploring investment opportunities in Pakistan.

Pakistan also participated in multiple global forums, including the Shanghai Cooperation Organization (SCO) Summit in China, the Islamic Summit in Doha, and the United Nations General Assembly session, where top Pakistani leadership engaged with global counterparts.

These developments helped instill renewed investor confidence in the country’s long-term economic trajectory, according to experts.

Domestic reforms add fuel to market

On the home front, the government announced key reforms and economic stabilization measures. The most notable is the long-awaited PKR 1.225 trillion circular debt settlement deal that was finalized to resolve the energy sector’s financial woes.

Meanwhile, the State Bank of Pakistan (SBP) has maintained the policy rate at 11% in its September meeting, signaling a cautious but stable monetary outlook amid post-flood recovery

The headline inflation eased further to 3.0% year-over-year in August, down from 4.1% in July, offering further room for potential monetary easing.

The current account deficit narrowed to USD 245 million in August, compared to USD 379 million in July, although still wider than USD 82 million in August 2024.

The SBP’s foreign exchange reserves have increased by USD 110 million, reaching USD 14.38 billion, strengthening Pakistan’s external position.

IMF engagement and global cooperation

Investor sentiment was further buoyed by the arrival of an IMF mission to conduct the second review of the Extended Fund Facility (EFF). Market participants expect Pakistan to meet all benchmark and performance criteria, which could pave the way for further disbursements and structural reform support.

At the same time, the possibility of renewed economic cooperation with both the US and China, along with stronger ties to the Gulf Cooperation Council (GCC) countries, is seen as a strategic win for Pakistan’s future economic diplomacy.

With a confluence of local liquidity, geopolitical developments, economic reforms, and a more benign inflation outlook, Pakistan’s capital markets are experiencing a rare period of sustained bullishness.

While analysts note the risk of volatility due to external shocks or political disruptions, many believe the rally could extend if macroeconomic and diplomatic momentum hold.

Comments

See what people are discussing