Solar makers race to cut silver use after 130% price surge

Shift to copper could unlock billions in savings as metal costs squeeze panel margins

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

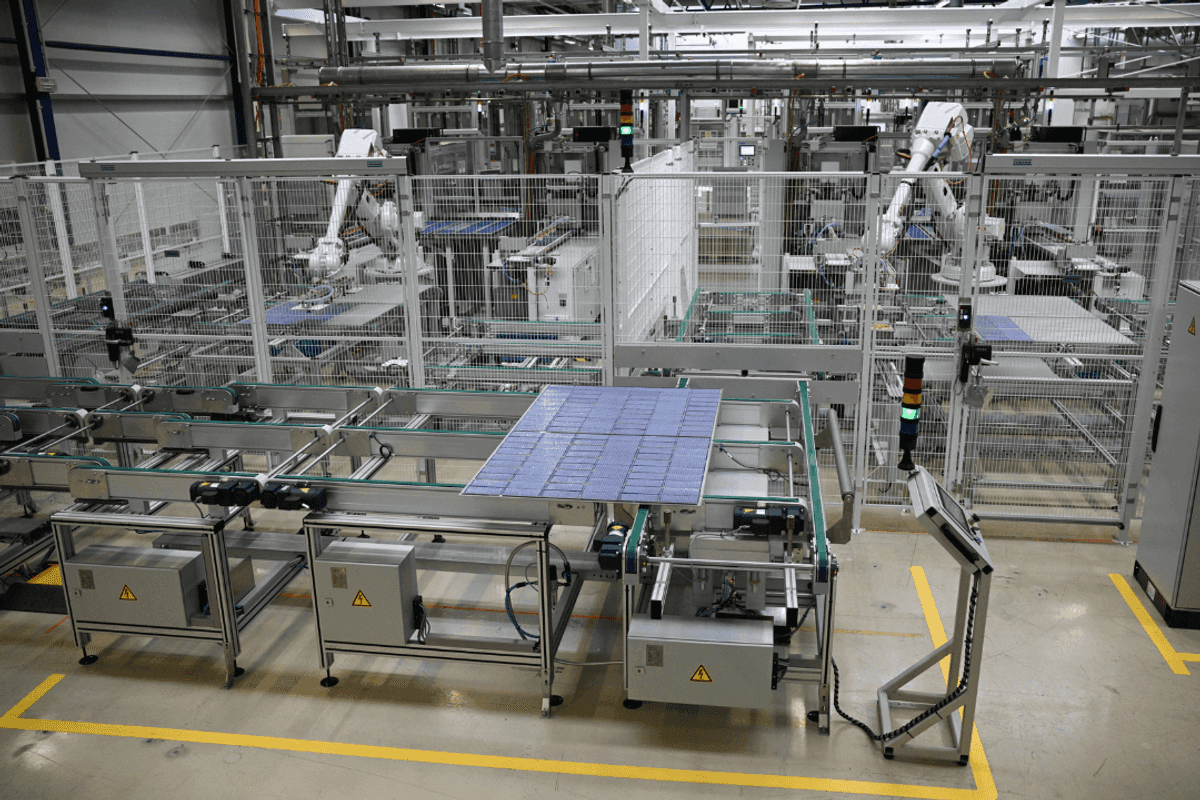

A solar panel rolls off the assembly line

Reuters

Solar panel manufacturers are accelerating efforts to replace silver with cheaper alternatives such as copper after silver prices surged 130% over the past year, squeezing margins already strained by global overcapacity, particularly in China, industry experts told Reuters.

“Silver is the greatest contributor to the increased cost of manufacturing solar panels,” Derek Schnee, senior commercial solar consultant at JK Renewables, told Reuters, adding that solar panel prices have risen between 7% and 15% over the last 12 months.

Silver paste — a critical component used in photovoltaic (PV) cells — accounts for around 30% of total solar cell production costs, analysts at Heraeus said.

After rallying 147% in 2025, silver touched an all-time high of $121.64 per ounce in January amid tight physical supplies and strong retail investor buying, before easing back to around $77 an ounce.

The photovoltaic sector consumes approximately 196 million troy ounces of silver annually, representing 17% of total global silver demand, according to industry estimates. Demand is also supported by jewellery, electronics and investment uses.

“In the U.S., silver paste costs per 450-watt module have increased from roughly $5.22 in early 2025 to about $17.65,” Ben Damiani, Chief Technology Officer at renewable power company Cherry Street Energy, told Reuters.

Shift to copper gains momentum

With silver trading at roughly $2.5 million per metric ton, manufacturers are increasingly turning to copper, which was last priced at $12,823 per ton.

China’s LONGi Green Energy Technology Co Ltd said in January it had made progress in developing cost-saving technologies using base metals and planned to begin mass production between April and June.

“Broader industry shifts are expected this year, with leading manufacturers moving to pure copper metallisation and hybrid silver-copper pastes,” Marius Mordal Bakke, vice president of solar supply chain research at Rystad Energy, told Reuters.

Billions in potential savings

With copper trading at roughly 0.5% of silver’s price, the cost-reduction potential is significant, Bakke said.

Damiani estimated that switching from silver to copper-based metallisation could generate approximately $15 billion in annual savings globally, based on 500 gigawatts of yearly solar production.

However, experts cautioned that replacing silver presents technical challenges due to its superior electrical conductivity compared with copper, making a full transition complex.

Still, as manufacturers grapple with tightening margins and volatile metal prices, the push toward copper-based solutions is expected to accelerate across the solar supply chain this year, industry analysts said.

Comments

See what people are discussing