Pakistan stocks surge on record current account surplus amid result season

Cement stocks rallied following a PKR 25 per bag price increase

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index gained 0.76%

PSX

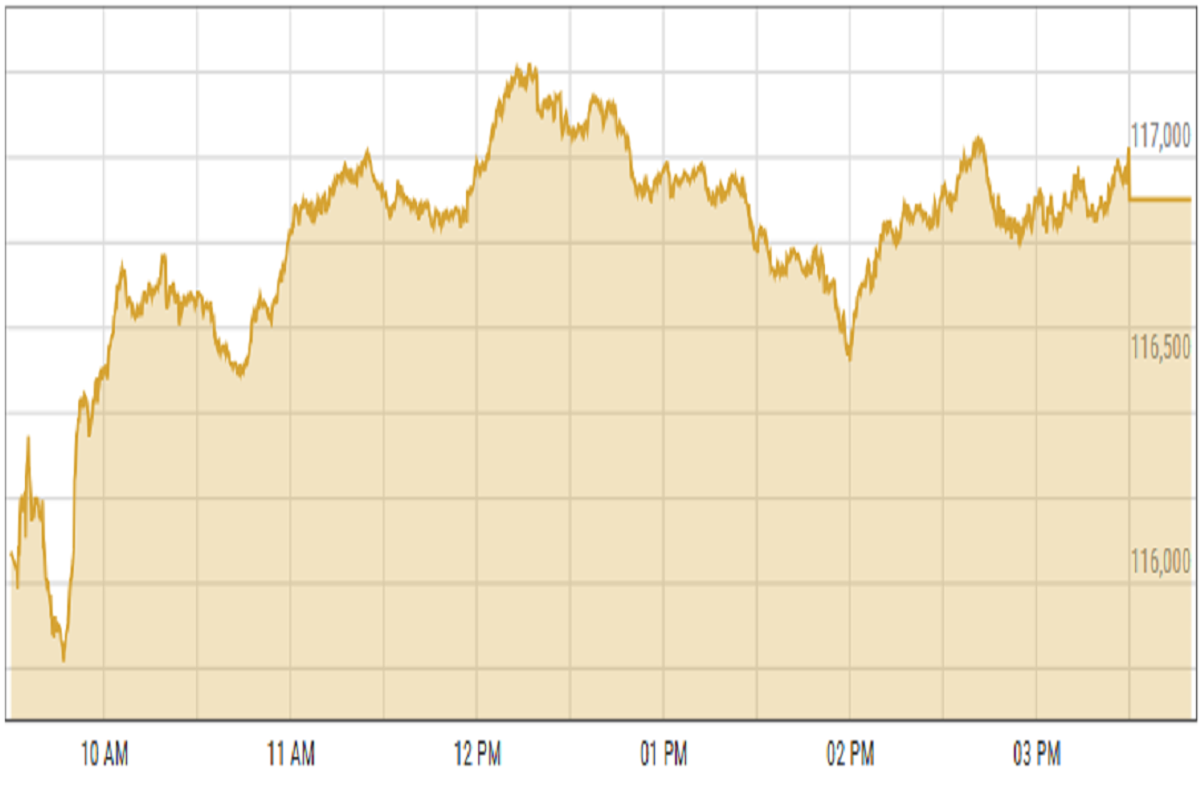

Pakistan stocks closed higher Thursday led by oil & gas sector and banks on reports of an agreement between government and banks to address circular debt.

Pakistan Petroleum surged 1.36%, Oil & Gas Development Company gained 1.2%, Pakistan State Oil soared 3.14%, Sui Southern Gas was 3.47% and Sui Northern Gas rose 3.33%. Moreover, United Bank increased 3.4%, Habib Bank was up 0.54% and National Bank gained 5.8%.

Analysts cited Fitch Ratings' outlook upgrade, a record $1.2 billion current account surplus, and excitement around the corporate earnings season as drivers behind the market’s positive momentum.

“Sentiment was lifted by Fitch’s outlook upgrade, a record $1.2 billion current account surplus, and result season excitement, which kept investor interest intact,” said an analyst at Ismail Iqbal Securities.

An analyst at Topline Securities noted that investor confidence was further strengthened by record-high remittances, contributing to a historic current account surplus in March 2025. The surplus for the first nine months of the fiscal year reached $1.9 billion.

Additionally, cement stocks rallied following a PKR 25 per bag price increase, further supporting the market's upward trajectory. Commercial banks, cement, and oil & gas exploration companies were the major contributors, collectively adding 657 points to the index.

KSE-100 index gained 0.76% or 881.03 points to close at 116,901.13 points.

Currency

US dollar eased against PKR in the inter-bank market. Pakistani currency gained 30 paisas to close at 280.62. In the open market USD was trading at PKR 282.3.

Indian Stocks

Indian stocks surged on Thursday, driven by strong gains in banking and financial services. The rally followed a dip in global investor sentiment after US Federal Reserve Chair Jerome Powell stated on Wednesday that the central bank would hold off on adjusting interest rates until there was greater clarity on the economic outlook.

India has been at the forefront of the global market recovery, consistently outperforming both Asian and Western counterparts. While trade tensions persist, they have eased somewhat after US President Donald Trump reversed certain tariff decisions and indicated a temporary halt on others, reigniting optimism in equities.BSE-100 index gained 1.55% or 380.07 points to close at 24,934.68 points.

DFM General Index gained 0.16% or 8.11 points to close at 5,061.52 points.

Crude Oil

Crude oil prices rose after the U.S. imposed new sanctions on Chinese firms trading Iranian oil. The restrictions, along with hawkish comments from the U.S. Treasury, fueled supply concerns.

The Trump administration targeted Iran’s oil exports, including a Chinese refinery, increasing pressure amid nuclear talks. Meanwhile, OPEC announced further output cuts from Iraq, Kazakhstan, and others to address overproduction.

Brent crude prices increased by 0.96% to $66.48 per barrel.

Gold Prices

Gold prices retreated on Thursday as investors took profits following bullion's record-breaking surge earlier in the session.

The rally was fueled by heightened demand for the safe-haven asset amid ongoing trade uncertainty and restrictions on chip sales to China.

Despite the pullback, the precious metal remains positioned for further gains as market turbulence persists.

International gold prices decreased 0.02% to close at $ 3,328.55 per ounce. In the local market, gold prices increased by PKR 2,000 to 350,000 per tola.

Comments

See what people are discussing