IMF warns corruption, weak oversight curb Pakistan’s growth

Report says governance and anti-corruption reforms could lift country’s GDP by up to 6.5%

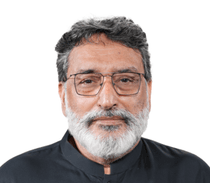

Haris Zamir

Business Editor

Experience of almost 33 years where started the journey of financial journalism from Business Recorder in 1992. From 2006 onwards attached with Television Media worked at Sun Tv, Dawn Tv, Geo Tv and Dunya Tv. During the period also worked as a stringer for Bloomberg for seven years and Dow Jones for five years. Also wrote articles for several highly acclaimed periodicals like the Newsline, Pakistan Gulf Economist and Money Matters (The News publications)

Reuters/File

Pakistan could expand its economic output by as much as 6.5% over five years if it adopts stronger governance and anti-corruption reforms, according to a Finance Ministry report citing International Monetary Fund analysis.

The Ministry of Finance released the Governance and Corruption Diagnostics Report after delaying its publication for nearly three months. The release was required by the IMF ahead of the lender’s executive board meeting, where approval of two loan tranches worth a combined $1.2 billion is on the agenda.

IMF modeling suggests Pakistan “could generate between a 5 to 6.5 percent increase in GDP” if it implements reforms focused on improving governance, strengthening accountability and enhancing business and trade regulations, the report says.

“These recommendations aim to advance meaningful reforms that would collectively strengthen the overall governance environment,” the report said.

It said the proposed measures emphasize empowering the private sector, improving public-sector performance and reinforcing the country’s anti-corruption framework.

Corruption risks and weak oversight

The report warns that corruption remains a “persistent challenge” with broad economic consequences. It identifies weakened public spending, poor revenue collection and reduced public trust as major symptoms of governance failures. It further notes that some of the most damaging forms of corruption involve “privileged entities that exert influence over key economic sectors, including those owned by or affiliated with the state.”

Pakistan faces “systematic governance weaknesses across state functions,” according to the document. Vulnerabilities include budgeting, fiscal reporting, public procurement and oversight of state-owned enterprises. The report also criticizes an “overly complex and opaque” tax system and intrusive regulatory practices that discourage business formation and investment.

Judicial shortcomings add another layer of economic risk, the report said. Case backlogs, outdated laws, judicial inefficiencies and questions about the integrity of some judges undermine contract enforcement and property rights. The result is reduced confidence in relying on courts for business disputes.

Corruption risks are compounded by fragmented accountability bodies and limited institutional independence. While Pakistan has exited the Financial Action Task Force’s “grey list,” the report notes continued challenges, including low conviction rates for corruption-related money laundering and insufficient monitoring of politically exposed persons.

A heavy state role in the economy, combined with capacity constraints and uneven oversight across ministries, contributes to “uneven access to state support” and restricts private-sector growth. The report also cites limited public access to information and few avenues for civil society engagement as factors that weaken rule-based governance.

Specific weaknesses identified in the report include ad hoc tax policy changes, governance issues within the Federal Board of Revenue, overlapping and opaque regulatory regimes, and concerns over the independence of financial-sector regulators.

The report highlights multiple gaps in the anti-money laundering system. These include difficulties verifying beneficial ownership data, inconsistent sanctions and enforcement, and legal ambiguities in the Anti-Money Laundering Act of 2010 that hinder timely prosecution, especially when corruption-related predicate offenses are difficult to establish.

While banks have shown “some signs of improvement” by occasionally raising questions about suspicious transactions linked to corruption, authorities continue to struggle to use Financial Intelligence Reports to initiate financial investigations. The report says mutual legal assistance remains limited despite recent reforms, in part because of weak cooperation from key jurisdictions.

Pakistan’s judicial sector faces governance issues that constrain the enforcement of economic rights and create exposure to corruption risks, the report says. It points to court delays, outdated laws, parallel court systems and varied human resource practices that raise questions about judicial independence and integrity. Existing oversight mechanisms for judicial performance and ethics, the ministry added, need strengthening.

Anti-corruption efforts remain overly dependent on a single politically exposed institution, the report states. Preventative systems such as asset declarations exist but are underused, limiting authorities’ ability to identify high-risk sectors or individuals for enhanced scrutiny.

Reform potential and IMF-linked gains

The document outlines a timeline of recommended actions, ranging from immediate interventions to medium- and long-term structural reforms. These aim to address governance weaknesses tied to corruption risks that constrain private-sector development, public-sector performance and accountability.

The ministry notes that Pakistan has shown the capacity to design and implement complex reforms in recent years. It cites central bank reforms to strengthen independence, the adoption of the State-Owned Enterprise Law, regulatory cancellations to improve the business climate, and widespread use of digital identification systems through the National Database and Registration Authority.

The report concludes that enhancing transparency, accountability and institutional capacity is essential for sustaining reforms and unlocking the economic gains projected by the IMF-supported analysis.

Comments

See what people are discussing