KSE-100 at 157,000: Rally over or more to come?

Escalating geopolitical tensions and delays in finalizing the power sector’s circular debt resolution plan dampened investor sentiment

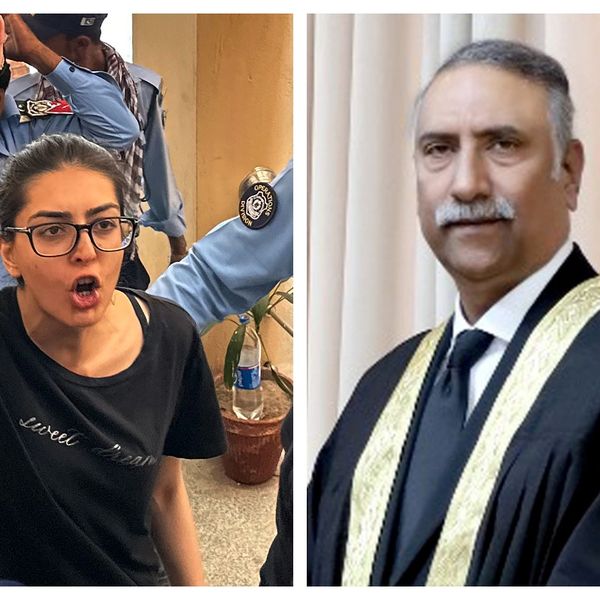

Shuja Qureshi

Presenter

With over 20 years of combined experience in media and stock brokerage, Shuja Qureshi is a seasoned professional who hosts a weekly stock market show on Nukta. Passionate about personal finance, he also presents 'How to Money with Shuja Qureshi' on Nukta.

Shahbaz Ashraf

Business Consultant

Seasoned Investment Professional | CFA | 17+ Years of Experience in Equity Research, Valuation & Advisory Seasoned investment professional with over 17 years of experience in equity research, financial analysis, valuations, and investment advisory—primarily focused on financial services firms, including equity brokerages, asset management companies, and family offices. Skilled in financial modeling, portfolio management, and evaluating multi-asset investment opportunities. Known for delivering data-driven insights and actionable strategies tailored to both institutional and private clients. Holds a BBA and MBA in Finance from the Institute of Business Management (IoBM), Karachi, and is a Chartered Financial Analyst (CFA).

The Pakistan Stock Exchange kicked off the week on a strong footing, with the benchmark KSE-100 index surging to an intra-week high of approximately 157,400 points.

However, escalating geopolitical tensions and delays in finalizing the power sector’s circular debt resolution plan dampened investor sentiment.

As a result, the index managed a modest gain of just 163 points, or 0.1%, closing the week at 154,440.

This week on Stock Watch, join Nukta’s Shuja Qureshi alongside Shahbaz Ashraf, Head of Research at Nukta, and Junaid Godil, SVP Institutional Sales at Arif Habib Limited, as they unpack the implications of rising leveraged positions and interest rates.

The panel explores whether the ongoing uncertainty around the circular debt resolution could trigger aggressive profit-taking and shift market dynamics in the coming weeks.

Comments

See what people are discussing