Pakistan’s Mari reports record oil production of 39M barrels

Company's profit after tax declines to PKR 65.1 billion due to higher royalty payments

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

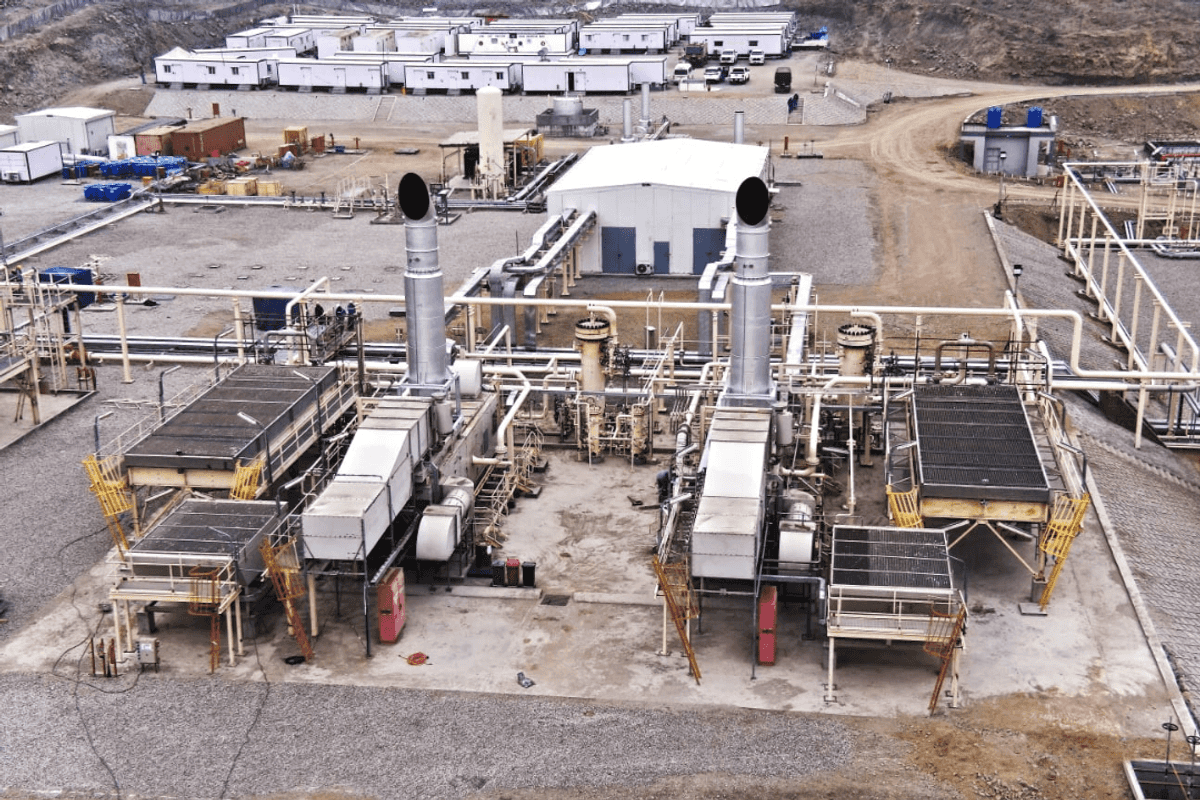

Mari Energies reported its highest-ever annual production of 39.13 million barrels of oil equivalent (MMBOE) in fiscal year 2025, up 0.31% year-over-year, despite a significant hit to earnings due to additional royalty charges.

At the company’s annual general meeting, the management revealed that the additional 15% royalty on production resulted in an estimated PKR 9 billion revenue loss during the year. Profit after tax declined to PKR 65.1 billion, compared to PKR 77.3 billion in FY24, also impacted by PKR 3.4 billion in lower product pricing and foreign exchange losses.

Despite the financial headwinds, the company maintained a dividend payout ratio of 40%, declaring a final dividend per share (DPS) of PKR 21.7, compared to PKR 25.7 in FY24.

Expansion target

The management highlighted the strong production potential of new discoveries, particularly in the Waziristan Block (Spinwam-1) and Sujawal Block (Soho-1). The Spinwam discovery alone added over 50 MMBOE to the company’s resource base through four newly identified horizons.

Currently, Spinwam is expected to produce around 30 million cubic feet per day (mmcfd) in its early phase, while Shewa is already producing 50–60 mmcfd.

MARI is also producing 48 mmcfd of gas from its Ghazij and Shawal fields in the Mari area. the management confirmed that gas allocation to fertilizer plants from these fields is under negotiation with the federal government. The process will require approval from the Economic Coordination Committee (ECC) and the federal cabinet.

The company clarified that these discussions are limited to Ghazij/Shawal only, as other major fields such as HRL are operating at full capacity.

The management emphasized that the full development of these fields could further boost output, although this would be contingent upon additional infrastructure investment.

With Shewa starting production in March 2025, Mari observed a quarter-on-quarter increase in oil output, driven by an additional 700 barrels per day (bpd) of condensate.

According to management, the company considers its domestic gas discoveries strategically important to replace imported RLNG volumes once the country’s long-term supply agreement with Qatar expires—a shift that could help conserve foreign exchange reserves.

On its international exploration front, Mari said that three discoveries in its Abu Dhabi Block hold an estimated 110 MMBOE in reserves. Further development plans will be reviewed in an upcoming board meeting with the Abu Dhabi National Oil Company scheduled for October 2025.

Tech and infrastructure projects

The company also provided updates on its technology and infrastructure ventures. Its 100%-owned subsidiary Mari Technologies and 60%-owned SKY47 are driving data center projects in Islamabad and Karachi.

The 5MW Islamabad data center is expected to be completed by early next year, while the Karachi facility is currently under construction. However, flooding has delayed progress at SKY47 by approximately one month.

Reserves

In an update about the company’s oil and gas reserves, the company reported:

- 2P (proved + probable) and 2C (contingent) reserves of 952 MMBOE

- 3P (proved + probable + possible) reserves and resources of 1,610 MMBOE

- 2P reserves alone stood at 775 MMBOE

The company stated that it has no direct exposure to the power sector’s circular debt. However, it stands to benefit from resolution efforts in the gas sector, which the government is reportedly prioritizing.

Comments

See what people are discussing