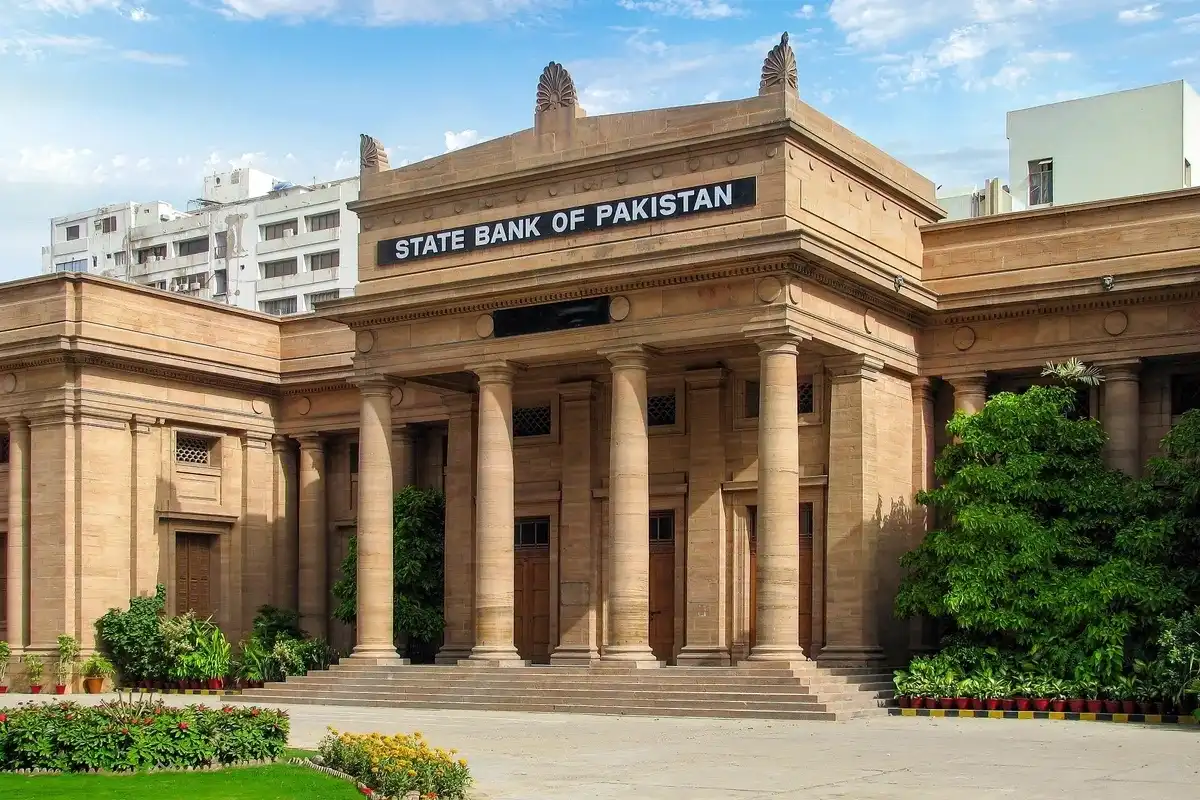

Pakistan keeps interest rate at 11% as inflation threat looms

Central bank says destruction caused by flood would impact overall economic outlook

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

Pakistan’s central bank left its key interest rate unchanged at 11% on Monday to manage the inflation, which could go up as destruction caused by floods is expected to push food prices and slow economic growth in the coming months.

The State Bank of Pakistan’s Monetary Policy Committee (MPC) said inflation stayed relatively low in July and August, and economic activity picked up, especially in large-scale manufacturing. However, the outlook has weakened slightly due to the impact of widespread flooding, especially in the agriculture sector.

“This temporary but significant shock may push up inflation and the trade deficit, while overall growth is expected to be lower than earlier projections,” the MPC said in a statement. “Given the uncertainty, the Committee found it appropriate to keep the policy rate unchanged to help maintain price stability.”

Flood impact and economic outlook

The MPC said the economy is in a better position to handle the flood impact compared to previous disasters. Lower inflation, steady domestic demand, and stable global commodity prices are expected to help keep inflation and external pressures in check. The central bank also credited two years of careful monetary and fiscal policies for building financial buffers.

Still, the committee acknowledged risks as key crops have been damaged, and food prices are already rising. As a result, real GDP growth in fiscal year 2026 is expected to be in the 3.25% to 4.25% forecast range.

On the external front, the current account deficit stood at $254 million in July, mainly due to higher imports. However, foreign exchange reserves remained steady at $14.3 billion as of September 5. The central bank expects reserves to rise to around $15.5 billion by the end of the year, helped by expected foreign inflows and steady remittances.

Inflation risks remain

Inflation rose to 4.1% in July before dropping to 3% in August. The MPC said these changes were mainly due to food and energy prices. Core inflation is still falling, but more slowly. The committee warned that food prices could rise further due to flood-related supply issues, although recent electricity price cuts may help offset some of the pressure.

Overall, inflation is expected to remain above the 5% to 7% target range for most of the second half of FY26, but is likely to return to that range in FY27. Risks to this forecast include ongoing flood damage, changes in global commodity prices, and potential increases in energy prices.

Stronger private sector credit

Private sector credit grew by 14.1% year-over-year, helped by stronger business activity and reduced government borrowing from banks. Credit growth was broad-based, with increases in loans to sectors like textiles, telecom, and retail.

Tax collection by the Federal Board of Revenue (FBR) grew by 14.1% in the first two months of FY26 but fell short of its target. A large profit transfer from the central bank and higher petroleum levies are expected to help the government achieve a budget surplus in the first quarter. However, the MPC warned that the floods could lead to higher spending and possibly slower revenue growth.

However, the MPC stressed the need for continued reforms, especially to expand the tax base and to restructure loss-making state-owned enterprises, to create more room for social spending, and to build resilience against future shocks.

The committee said the current interest rate is still high enough to help keep inflation under control, even with some short-term price increases expected.

“Despite the uncertainties, the economy continues to show signs of strength,” the MPC said. “With careful policy and continued reforms, Pakistan can navigate the current challenges and return to a sustainable growth path.”

Comments

See what people are discussing