Pakistan misses October tax revenue target by a staggering PKR 102 billion

The FBR managed to collect only PKR 878 billion in tax revenue against a target of PKR 980 billion

Shahzad Raza

Correspondent

Shahzad; a journalist with 12+ years of experience, working in Multi Media. Worked in Field, covered Big Legal Constitutional and Political Events in Pakistan since 2012. Graduate of Islamic University Islamabad.

The FBR managed to collect only PKR 878 billion in tax revenue against a target of PKR 980 billion

Shutterstock

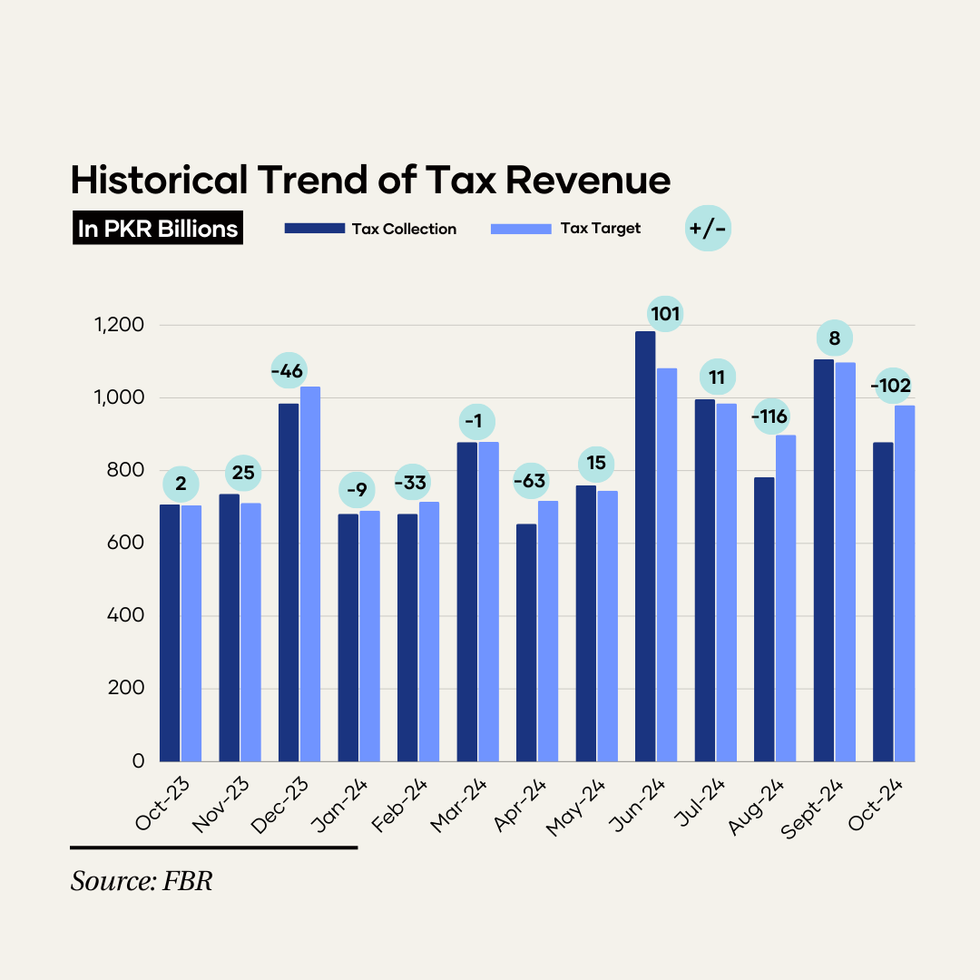

Pakistan failed to meet its monthly tax collection target for the second time in fiscal year 2024-2025 (FY25), officials informed Nukta on Thursday.

Its tax collection authority — the Federal Board of Revenue (FBR) — managed to collect only PKR 878 billion in tax revenue against a target of PKR 980 billion, a difference of PKR 102 billion.

In July, the FBR collected PKR 996 billion against a target of PKR 985 billion. However, the next month, it collected PKR 782 billion against a target of PKR 898 billion.

While the FBR managed to collect PKR 1,106 billion in September against a target of PKR 1,098bn, it missed the quarterly target by PKR 90 billion.

The overall revenue shortfall has surged to PKR 192 billion in four months.

It is pertinent to note that the Pakistani government has also agreed with the International Monetary Fund (IMF) that it will impose seven new taxes during FY25 in case revenue collection falls short of the projected target by 1% during the current fiscal year.

The FBR has received a record 4.436 million income tax returns for the tax year 2024, over 100% increase from the 2.17 million returns filed for the previous year.

However, out of the 4.436 million returns, 1.636 million were nil-income returns, meaning no tax was deposited with these filings.

This is a notable rise from the 778,137 nil-income returns filed out of the 2.166 million total returns last year.

Comments

See what people are discussing