Pakistan seeks private investment to boost startups and economic reforms

Finance minister hosts delegation to discuss boosting Pakistan’s venture capital for startups

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

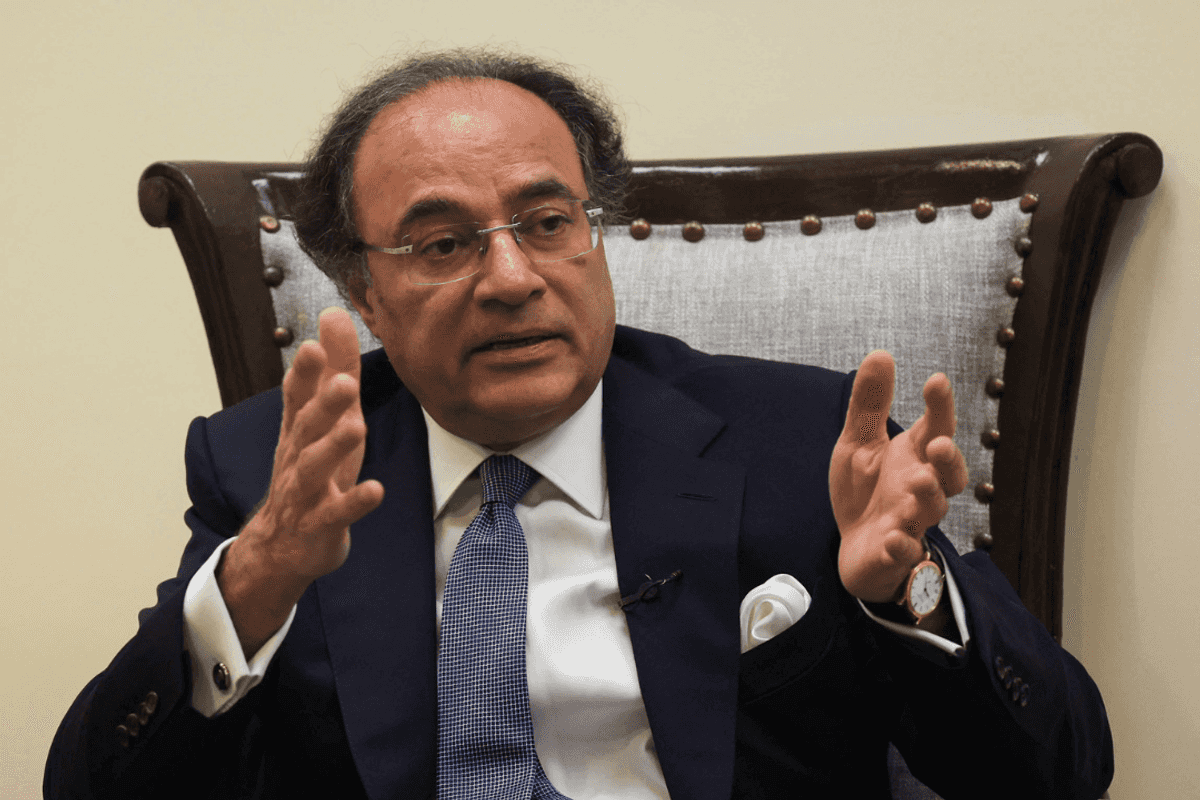

Pakistan’s Finance Minister Muhammad Aurangzeb has stepped up efforts to attract private investment and support economic reforms, meeting recently with a regional venture capital firm and an international delegation of investors. The meetings underline Islamabad’s focus on mobilizing capital to stabilize and diversify the economy.

On Dec. 15, Aurangzeb hosted a delegation from Gobi Partners, led by Chairman Thomas Tsao, at the Finance Division. Discussions centered on strengthening Pakistan’s venture capital ecosystem and expanding access to risk capital for startups.

The minister welcomed the firm’s interest, highlighting the government’s commitment to private sector-led growth, deepening financial markets, and promoting technology-driven economic diversification. He stressed that access to venture capital is vital for scaling startups, fostering innovation, and generating sustainable employment.

Gobi Partners briefed the minister on its investments in Pakistan through Techxila Fund I, launched in 2020, which has supported startups in fintech, e-commerce, and digital infrastructure. The firm said its participation has attracted additional foreign investment while contributing to job creation and financial inclusion.

The delegation also outlined plans for Techxila Fund II, a proposed $50 million fund targeting high-growth sectors such as fintech, logistics, health technology, and software services. Gobi Partners intends to anchor the fund with its own capital while mobilizing domestic and international institutional investors.

Both sides discussed the need for a supportive regulatory and tax framework for venture capital and private equity, including greater participation by domestic financial institutions and consideration of tax pass-through status for investment funds. Aurangzeb reaffirmed the government’s commitment to macroeconomic stability and investment facilitation, noting that mobilizing domestic capital alongside foreign investment is key to fostering innovation-led growth.

In a separate meeting, Aurangzeb met with a delegation of international investors including representatives from the International Finance Corporation, British International Investment, the Asian Development Bank, and Baltoro Capital.

The discussions focused on private sector-led growth, investment mobilization, and cooperation to support Pakistan’s ongoing reform agenda. Aurangzeb highlighted progress over the past 18 months in restoring macroeconomic stability, citing improved currency stability and foreign exchange reserves projected to cover roughly three months of imports by year-end.

The minister also outlined Pakistan’s trade liberalization program, including tariff rationalization to enhance competitiveness, and reforms aimed at reducing the investment deficit and creating a predictable business environment.

Additional topics included energy sector reforms, tax policy improvements, and measures to broaden the tax base and enhance collection mechanisms. Aurangzeb noted Pakistan’s adherence to debt repayment obligations and plans to access international debt markets through instruments including an inaugural Panda Bond and a Global Medium-Term Note framework.

Investor representatives reaffirmed support for Pakistan’s reform and investment agenda, emphasizing private sector participation, private equity investment, and mobilization of domestic and foreign capital.

Both meetings concluded with commitments to ongoing engagement in support of a more stable, investment-friendly, and private sector-driven growth model, according to Finance Division statements.

Comments

See what people are discussing