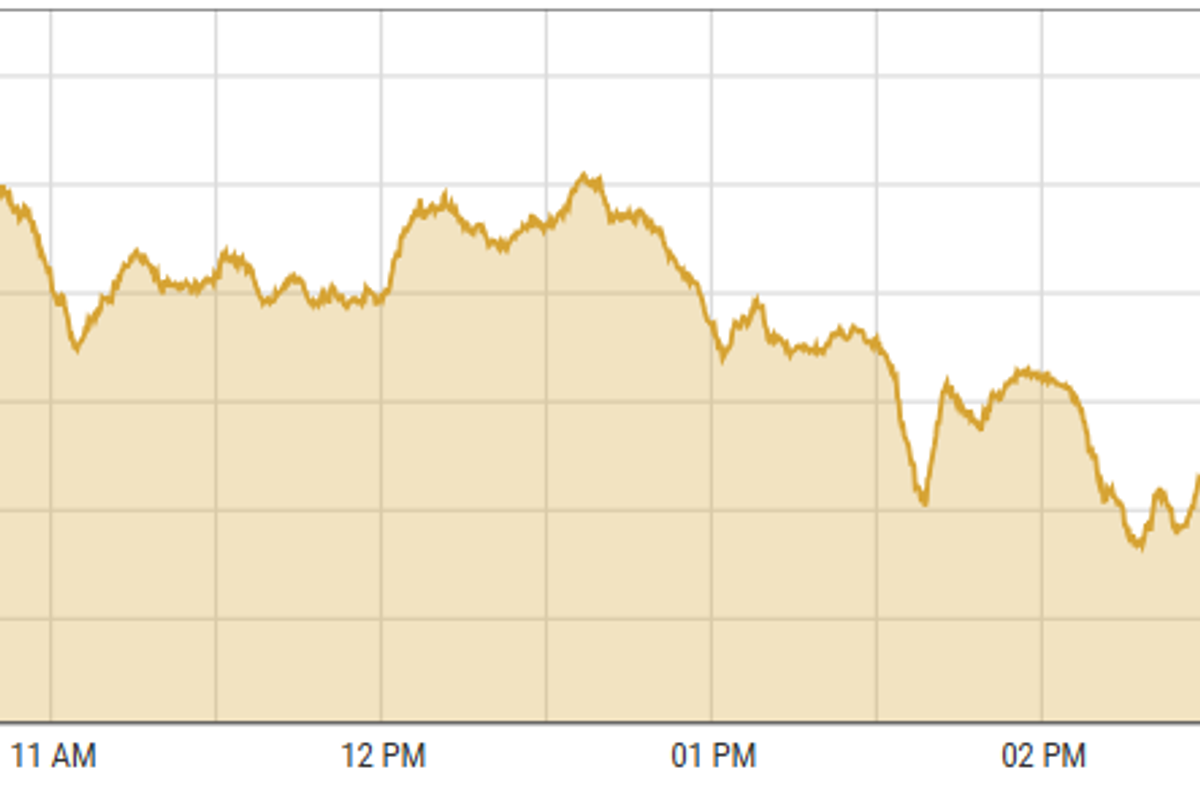

Pakistan stocks decline amid institutional profit taking

Increasing cost of financing to buy shares triggered market downturn

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index shed 1.33%

PSX

Pakistan's stock market closed lower on Tuesday amid significant volatility as investors capitalized on profit-taking opportunities, contributing to market fluctuations.

Concerns over rising leverage and costs of borrowing to buy shares drove investors to pare down their portfolios, ahead of the December contract's expiration.

The fertilizer, oil & gas exploration, and commercial banks led the decline, collectively pulling the index down by 948 points.

The market's cautious tone reflected a heightened risk perception among participants.

KSE-100 index shed 1.33% or 1,509.61 points to close at 112,415 points.

Indian stock indexes fell on Tuesday because of drops in IT and metal stocks.

Trading is expected to remain within a narrow range for the next few days due to the lack of significant events or news.

Analysts believe the indexes won't see big gains until early January when companies start reporting their earnings for the December quarter.

BSE-100 index shed 19.91 points or 0.08% to close at 25,137.89 points.

DFM General index gained 28.29 points or 0.56% to close at 5,084.62 points.

Commodities

Oil prices went up on Tuesday due to a somewhat positive short-term market outlook.

The prices are expected to stay about the same for now because activity in the markets typically slows down during the holiday season, and market participants are waiting for a clearer picture of the global oil situation for 2024 and 2025.

Brent crude prices gained 0.85% to $73.25 per barrel.

Gold prices have stabilized because investors are being cautious due to mixed signals from the US Federal Reserve.

After dropping 0.4% earlier this week, gold has bounced back a bit in light holiday trading.

Investors are assessing the impact of the recent drop in US consumer confidence, which fell unexpectedly in December, raising concerns about the economic outlook.

International gold prices inched up 0.14% reaching $2,615.07 per ounce.

Currency

US dollar eased against PKR in the inter-bank market, down 0.03%. Pakistani currency settled at 278.47 with a gain of 9 paisas. In the open market USD was trading at PKR 279.

Comments

See what people are discussing