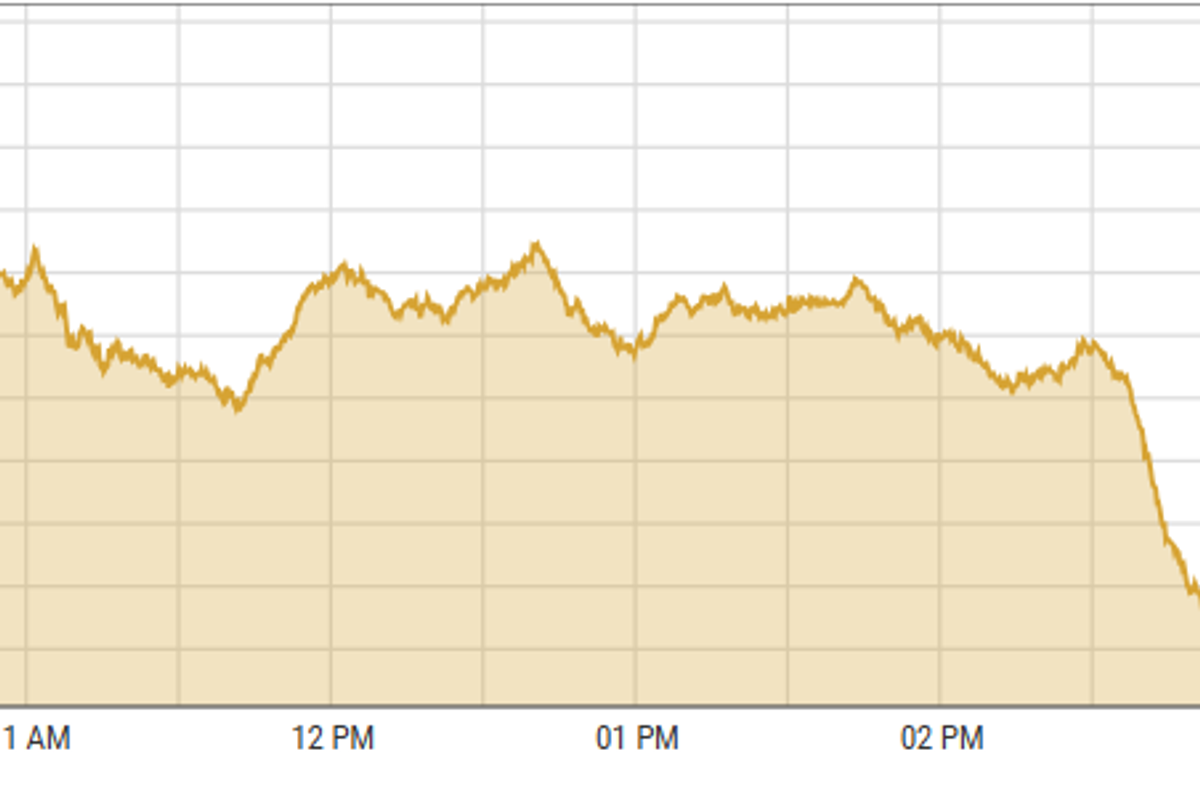

Pakistan stocks decline due to profit selling in over-bought market

KSE-100 index shed 0.49% to close at 90,286.57 points

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

After a streak of all-time highs, Pakistan's stock market experienced a correction on Wednesday. The decline was primarily driven by institutional profit-taking in overbought stocks.

The benchmark index has increased over 10% in the current month, therefore investors opted to sell to secure their returns. Besides, the corporate results have not been quite exciting.

The bearish close was further influenced by several factors, including foreign outflows and proposed increase in industrial gas tariffs.

KSE-100 index shed 577.52 points or 0.49% to close at 90,286.57 points.

Indian stocks ended their two-day winning streak, closing lower on Wednesday amid mixed global cues.

The market was volatile and finished down nearly half a percent.

After an initial dip, it traded within a range, ending near the lower end. Most sectors declined, except for FMCG, with banking, pharma, and IT leading the losses.

However, broader indices showed resilience, with the small-cap index gaining over a percent.

India’s BSE 100 Index lost 0.44% or 113.33 points to close at 25,674.59 points.

The Dubai Financial Market (DFM) General Index gained 0.46% or 21.16 points to close at 4,604.52 points.

Commodities

Oil prices are stabilizing, supported by a surprise drop in US crude oil inventories. The American Petroleum Institute (API) reported a fall of 0.573 million barrels, against expectations of a 2.3 million-barrel increase. Investors await the EIA's report on Wednesday.

Oil prices faced pressure after reports suggested Israeli Prime Minister Netanyahu would discuss a diplomatic solution to the Lebanon conflict. However, a US plan to buy 3 million barrels for its Strategic Petroleum Reserve (SPR) provided some support.

Crude prices may face challenges as OPEC+ plans to ease production cuts in December, aiming to increase output by 180,000 barrels per day.

Brent crude prices surged 1.06% to $72.18 per barrel.

Gold prices continued to rise due to increased demand for safe-haven assets amid US election jitters and Middle East tensions.

A slight decrease in US Treasury bond yields also supports gold.

However, expectations of smaller interest rate cuts by the Federal Reserve and concerns about post-election deficit spending are boosting US bond yields and the US Dollar.

This limits gold's gains, with traders waiting for key US economic data.

International gold prices increased 0.36% reaching $2,778.7 per ounce. In Pakistan, gold prices surged by PKR 2,300 to PKR 287,300/tola on Wednesday.

Currency

US dollar gained ground against PKR, up 0.02% in the inter-bank market. Pakistani currency settled at 277.79, a loss of 5 paisas against the US dollar. In the open market USD was trading at PKR 280.

Comments

See what people are discussing