Pakistan stocks little changed in absence of triggers

IMF review uncertainty kept market participants in a wait-and-see mode

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index shed 0.08%

PSX

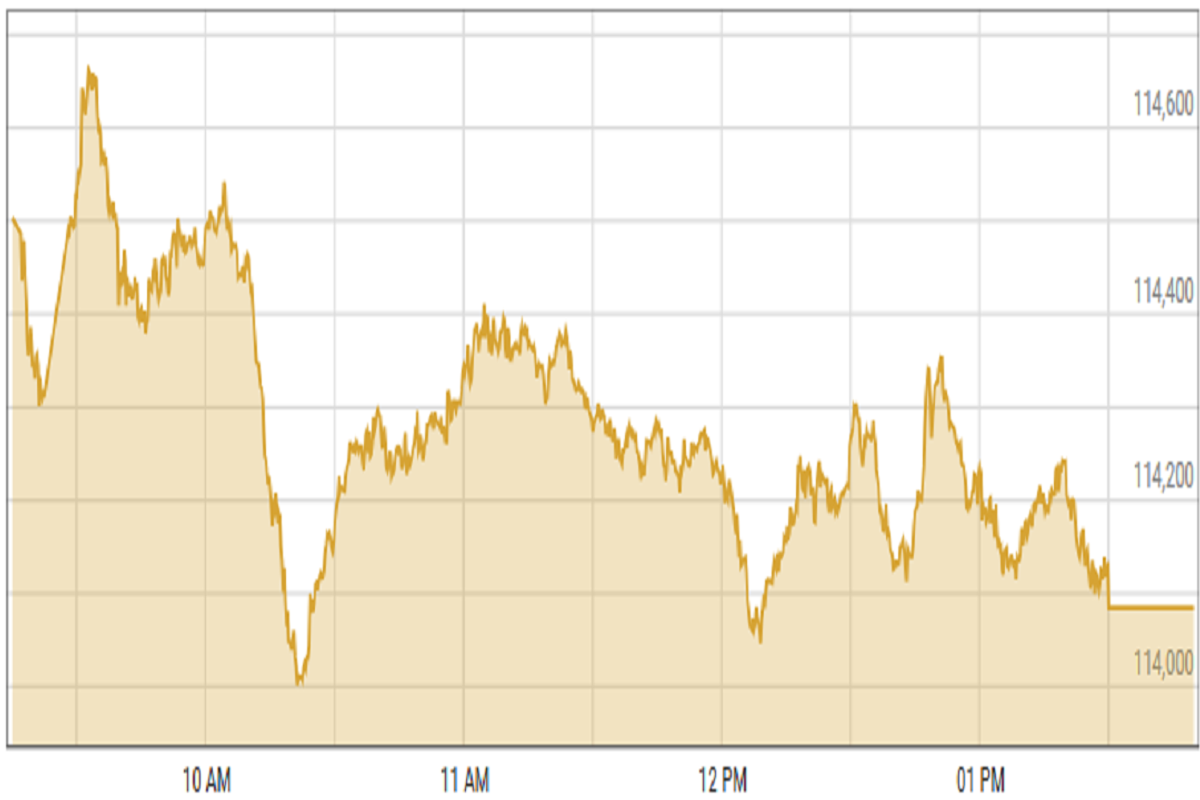

Pakistan stocks closed relatively flat, with analysts attributing the lackluster performance to a dearth of positive triggers and uncertainty surrounding the ongoing International Monetary Fund (IMF) review.

"Uncertainty surrounding further developments in the IMF review kept market participants in a wait-and-see mode," said an analyst at Ismail Iqbal Securities.

Dealers said the market was also concerned about the worsening security situation in country after a train was attacked in Baluchistan.

An analyst at Topline Securities said the local stock market experienced a mixed session, with the benchmark index fluctuating between a peak of +484 points and a low of -176 points. "The market's performance was influenced by the ongoing IMF review.”

An analyst at JS Global capital said market declined due to profit-taking in key sectors, despite earlier gains driven by buying activity in oil and gas exploration, OMCs, refinery, and power generation stocks.

“Looking ahead, the market is expected to remain cautious, with investors closely monitoring macroeconomic developments and the anticipated second tranche of $1 billion from the IMF.”

Major sectors such as fertilizers, automobile assemblers, and commercial banks were the primary laggards, collectively shedding 155 points from the index.

KSE-100 index shed 0.08% or 93.12 points to close at 114,084.54 points.

US dollar steadied against PKR in the inter-bank market. Pakistani currency lost 2 paisas to close at 279.97. In the open market USD was trading at PKR 281.6.

Indian Stocks

Indian stocks ended with little change on Wednesday, following mixed signals from global markets. The Indian stock market is experiencing an unusually prolonged downturn, with a 16% decline from its peak.

Analysts explain that the main reason for this is a slowdown in consumer spending and weak prices in the oil, gas, and steel sectors, which affected growth.

BSE-100 index lost 0.14% or 33.28 points to close at 23,407.77 points.

DFM General Index gained 0.34% or 17.20 points to close at 5,139.04 points.

Commodities

Crude oil prices went up slightly after dropping sharply at the beginning of the week. This happened because Asian countries are buying more oil and the dollar is weaker, which should increase demand.

The U.S. Energy Information Administration changed its forecast for oil supply and demand for this year and next. Additionally, the head of the International Energy Agency said that more money needs to be invested in new oil and gas supplies.

Brent crude prices increased by 0.72% to $70.06 per barrel.

Gold prices rose slightly on Wednesday, as investors created fresh positions in response to firm spot demand.

International gold prices increased by 0.03% reaching $2,916.32 per ounce.

Comments

See what people are discussing