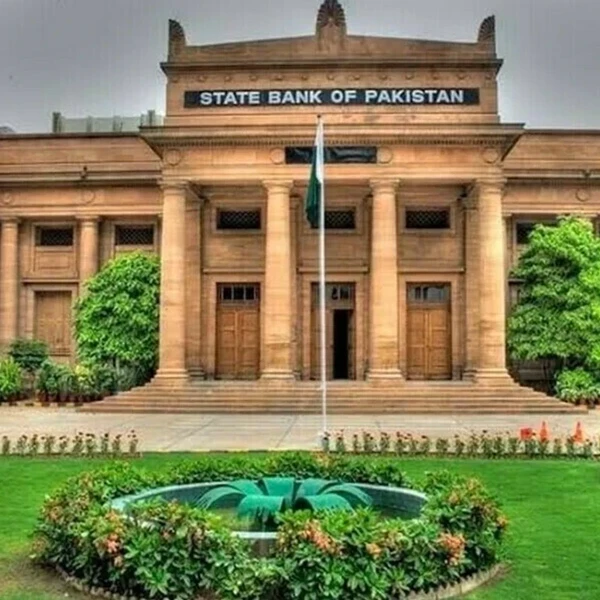

Pakistan stocks rally led by banks amid falling lending rates

KSE-100 index gained 0.48% to close at 97,798.23 points

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

PSX

Pakistan's stock market closed at a new all-time high, driven by positive investor sentiment due to falling lending rates and banks imposing fees on large deposits to avoid taxes.

The index ended the day on a high note, reaching its peak both during the day and at the close, despite a volatile session with a 2,000-point swing between the high and low points as profit-taking increased in the second half.

Major contributions to the index came from Commercial Banks, Oil & Gas Marketing Companies, and the Textile Composite sectors, adding a total of 1,385 points.

Analysts said the market is experiencing a significant resurgence, with trading activity reaching record levels. Today's cash/ready volume at the Pakistan Stock Exchange (PSX) exceeded PKR 45 billion (about $160 million), a milestone not seen in over 8 years.

KSE-100 index gained 469.83 points or 0.48% to close at 97,798.23 points.

On the last trading day of the week, Indian stock markets surged thanks to positive global signals and a stronger US labor market. Gains in IT, real estate, and PSU banks lifted investor spirits.

Notably, Adani Group stocks rebounded into the green after earlier losses due to allegations by the US Department of Justice and the US Securities and Exchange Commission. The markets rallied from a key support level, driven by foreign investors moving from futures to cash markets, suggesting a technical rebound rather than a fundamental change.

BSE-100 index gained 547.43 points or 2.22% to close at 25,209.82 points.

The Dubai Financial Market (DFM) General Index gained 0.76% or 36.13 points to close at 4,767.85 points.

Commodities

On Friday, oil prices dipped slightly. However, WTI and Brent prices climbed sharply this week due to worries about supply disruptions from Russia, bringing back risk premiums. The conflict between Russia and Ukraine has escalated as it nears its three-year mark.

Meanwhile, the US Dollar Index (DXY) rose after European preliminary PMI numbers for November were much lower than expected, indicating that business activity in the Eurozone's Manufacturing and Services sectors has shrunk. This situation led to a stronger inflow into the US Dollar.

Brent crude prices declined 0.77% to $73.65 per barrel.

Gold prices surged as renewed geopolitical tensions over nuclear risks in the Russia-Ukraine conflict sparked safe-haven demand.

Reports of escalating tensions and global unease pushed gold prices higher.

International gold prices surged 0.99% reaching $2,699.68 per ounce. In Pakistan, gold prices increased by PKR 2,500 to PKR 280,500/tola.

Currency

US dollar eased against PKR, down 0.08% in the inter-bank market. Pakistani currency settled at 277.75, a gain of 20 paisas against the US dollar. In the open market USD was trading at PKR 280.

Comments

See what people are discussing