Pakistan's FBR set to miss tax collection target by PKR 113 billion in Aug

FBR chairman directs all field offices to remain open till 8PM on Saturday for collection, sources say

Shahzad Raza

Correspondent

Shahzad; a journalist with 12+ years of experience, working in Multi Media. Worked in Field, covered Big Legal Constitutional and Political Events in Pakistan since 2012. Graduate of Islamic University Islamabad.

A Federal Board of Revenue office

FBR website

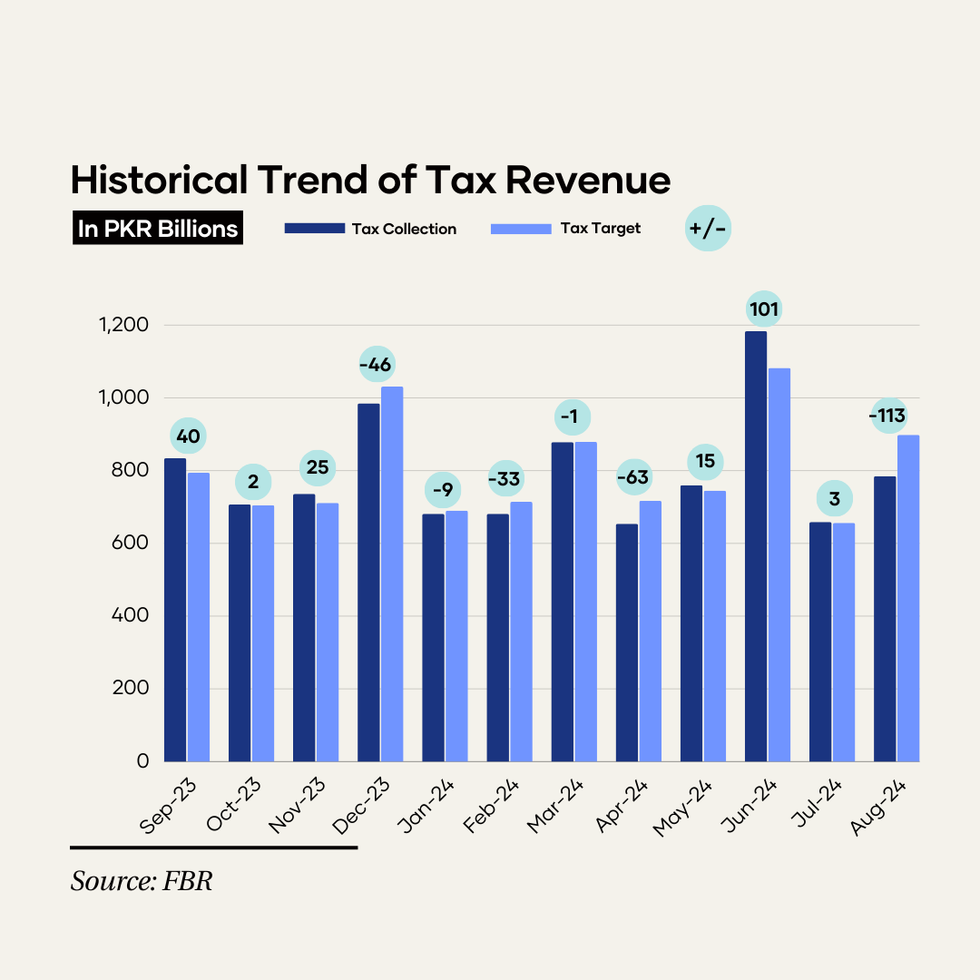

Pakistan's Federal Board of Revenue (FBR) is set to miss the tax collection target for August by PKR 113 billion — the highest shortfall since December 2022 — sources told Nukta on Friday.

The FBR collected PKR 785 billion till August 30 compared to a target or PKR 898 billion, they said. Of this amount, PKR 340 billion was collected in income tax, PKR 335 billion in sales tax, PKR 58 billion in federal excise duties and PKR 93 billion in customs duties.

Last month, the FBR had collected PKR 659 billion compared to a target of PKR 656 billion.

However, this gap in tax collection may narrow slightly to PKR 103 billion as the FBR's field formations may collect up to PKR 10 billion on Saturday (Aug 31).

FBR Chairman Rashid Langrial issued directions to all field formations to keep their offices open till 8PM on Saturday, the sources said.

Moreover, he also called a meeting with chief commissioners of different departments on Saturday to make a strategy for meeting quarterly and annual tax collection target of PKR 12.92 trillion.

According to the sources, Langrial had commissioned a report that identified tax loopholes worth PKR 4.5 trillion in sales tax collection alone, which he would present to the prime minister next week.

They also informed Nukta that as part of Pakistan's $7 billion loan program with the International Monetary Fund (IMF), if the FBR fails to meet the tax collection target by over PKR 100 billion in the first quarter of this fiscal year, the government would announce a "mini-budget" imposing additional taxes amounting to PKR 200 billion.

The sources further said the FBR estimates a shortfall of PKR 600 billion in its tax collection target for fiscal year 2024-25.

Comments

See what people are discussing