Pakistan stocks surge as political uncertainty eases

Investors viewed the conviction of the PTI founder as a positive development

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index gained 1.26%

PSX

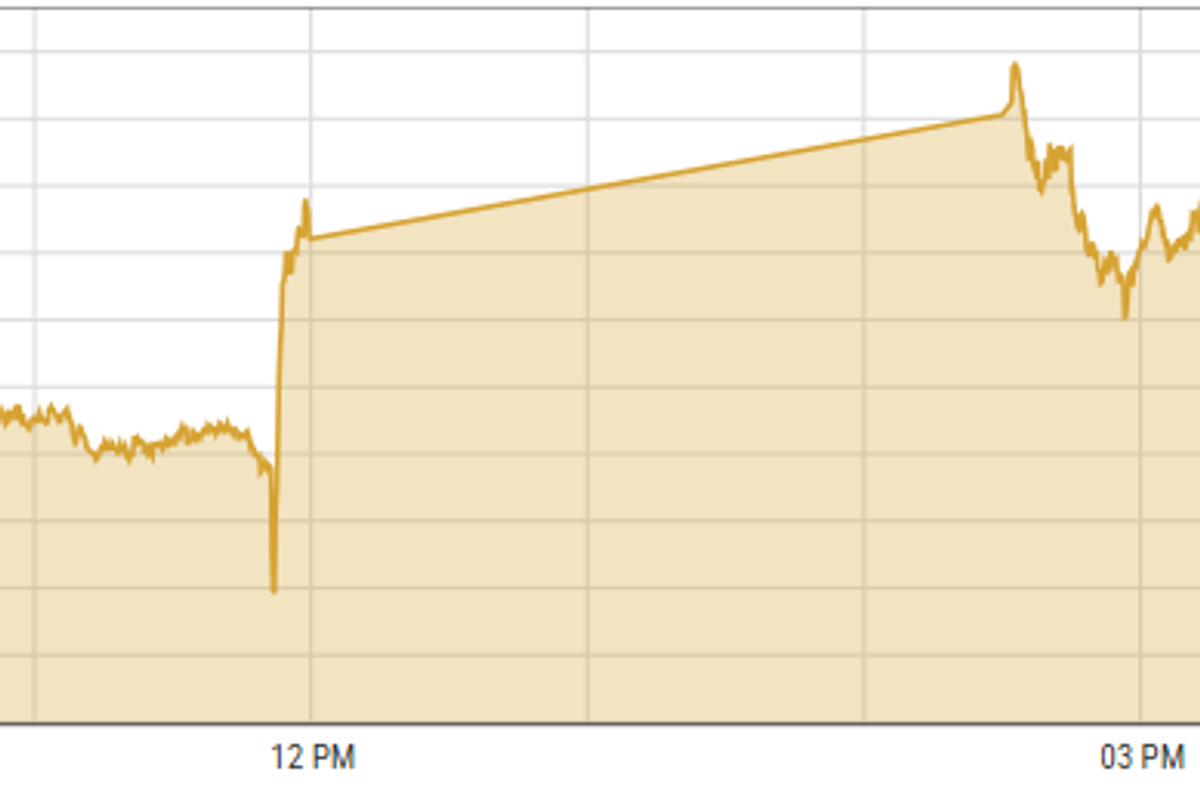

Pakistan's stock market experienced a robust session on Friday, with the Pakistan Stock Exchange (PSX) gaining 1.2%.

Stocks closed bullish during the earning season rally at PSX, led by scrips across the board. Investors viewed the conviction of the PTI founder as a positive development, potentially paving the way for breakthrough talks between the government and PTI.

Falling lending rates, surging State Bank of Pakistan (SBP) forex reserves amid a $2 billion UAE deposit rollover, and easing political noise played a catalytic role in the surge at PSX.

KSE-100 index gained 1.26% or 1,435.34 points to close at 115,272.08 points.

The Indian stock market ended its three-day winning streak on Friday due to heavy selling in banking stocks.

There are worries because top Indian tech companies didn't meet their earnings expectations.

BSE-100 index shed 0.29% or 72.39 points to close at 24,464.36 points.

DFM General Index lost 0.46% or 24.1 points to close at 5,211.73 points.

Commodities

Oil prices are set to rise again this week, continuing a three-week streak due to U.S. sanctions on Russia affecting supply.

China's GDP growth of 5% also supports prices, as its economy still relies on oil. Supply concerns and hopes for demand recovery are boosting the market.

Brent crude prices gained 0.09% to $81.36 per barrel.

Gold prices dropped on Friday as investors took profits after a recent surge.

The stronger dollar also made gold more expensive for buyers using other currencies, reducing demand.

International gold prices decreased 0.40% reaching $2,708.23 per ounce.

Currency

US dollar eased against PKR in the inter-bank market. Pakistani currency gained 14 paisas to 278.71. In the open market USD was trading at PKR 281.

Comments

See what people are discussing