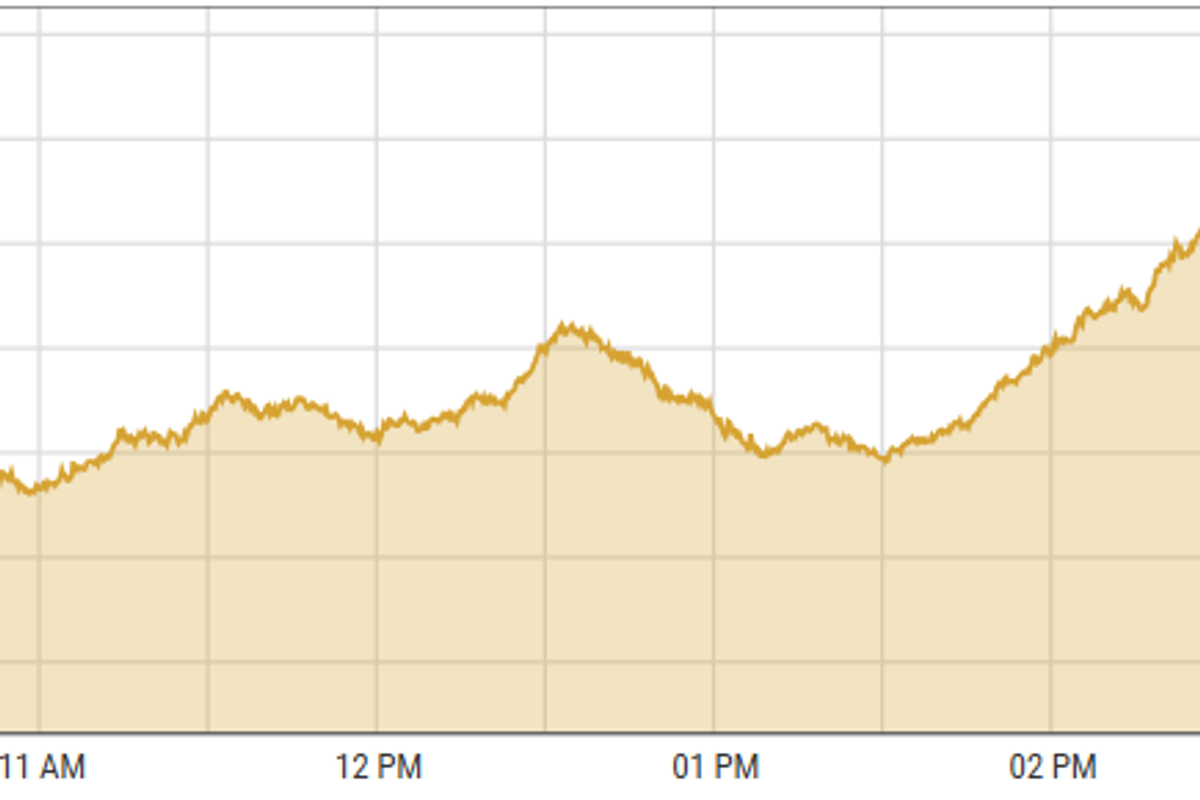

Pakistan stocks surge to record high amid surging liquidity and trading volumes

KSE-100 index gained 2.98% to close at 108,239 points

Business Desk

The Business Desk tracks economic trends, market movements, and business developments, offering analysis of both local and global financial news.

KSE-100 index gained 2.98%

PSX

Pakistan stocks closed on a high note on Thursday, reaching yet another milestone.

The market's liquidity rally continued, with trading volumes reaching a 19-year peak, marking the third-largest point gain in history.

The commercial banks, oil & gas exploration companies, and fertilizer sectors played a significant role in today’s performance, contributing a total of 1,806 points to the index.

Analysts attribute index rally this year to sustained aggressive buying of mutual funds, particularly in the latter half of the year. This rally has been driven by declining fixed-income yields amidst a stable macroeconomic environment.

The KSE-100 gained 3,135 points or 2.98% to close at 108,239 points.

On Thursday, Indian stock prices went up, especially for IT companies that do a lot of business in the US. The rise happened because the head of the US Federal Reserve, Jerome Powell, said the US economy was doing better than expected.

IT stocks increased by around 2%. Financial stocks also turned around from earlier losses and ended up 0.7% higher, as people are expecting easier monetary policies from the Reserve Bank of India.

BSE-100 index gained 223.84 points or 0.86% to close at 26,178.66 points.

DFM General index shed 39.99 points or 0.82% to close at 4,813.65 points.

Commodities

Crude oil prices were under pressure for the second consecutive day, despite support ahead of the OPEC+ meeting.

Reports suggest OPEC+ will delay plans to increase production until at least Q2 2025 due to concerns over slowing demand, particularly from China.

Geopolitical risks, including the Russia-Ukraine conflict and Middle East tensions, also support oil prices. US oil inventories fell more than expected, and signs of economic resilience in the US, along with potential policy boosts under President-elect Donald Trump, could limit further losses.

Traders are awaiting the US Nonfarm Payrolls report, which could impact expectations for Fed rate cuts and influence oil prices.

Brent crude prices increased 0.5% to $72.67 per barrel.

Gold is under pressure. Investors now expect the Federal Reserve to adopt a cautious approach on rate cuts, supported by hawkish comments from several FOMC members, including Fed Chair Jerome Powell.

This has helped US Treasury bond yields recover slightly, which in turn weighs on gold, a non-yielding asset.

However, ongoing geopolitical tensions from the Russia-Ukraine conflict and concerns over US president-elect Trump’s tariff plans provide support for gold.

International gold prices declined 0.03% reaching $2,644.57 per ounce. In Pakistan, gold prices remain unchanged at PKR 275,200 per tola.

Currency

The PKR steadied against the US dollar in the interbank market, down 0.01%. Pakistani currency settled at 277.94 with a loss of 2 paisas. In the open market, USD was trading at PKR 279.

Comments

See what people are discussing